Cyber insurance coverage Silverfort is designed to help organizations comply with the stringent Multi-Factor Authentication (MFA) requirements set by cyber insurance policies. Silverfort’s Unified Identity Protection platform ensures full compliance by adding MFA to all on-premises and cloud resources, including legacy systems, remote network access, internal and external admin access, networking infrastructure, directories, IT & Security Management, and servers & workstations. This is done agentless and proxyless so you can deploy in days or even hours to meet your insurer’s deadlines.

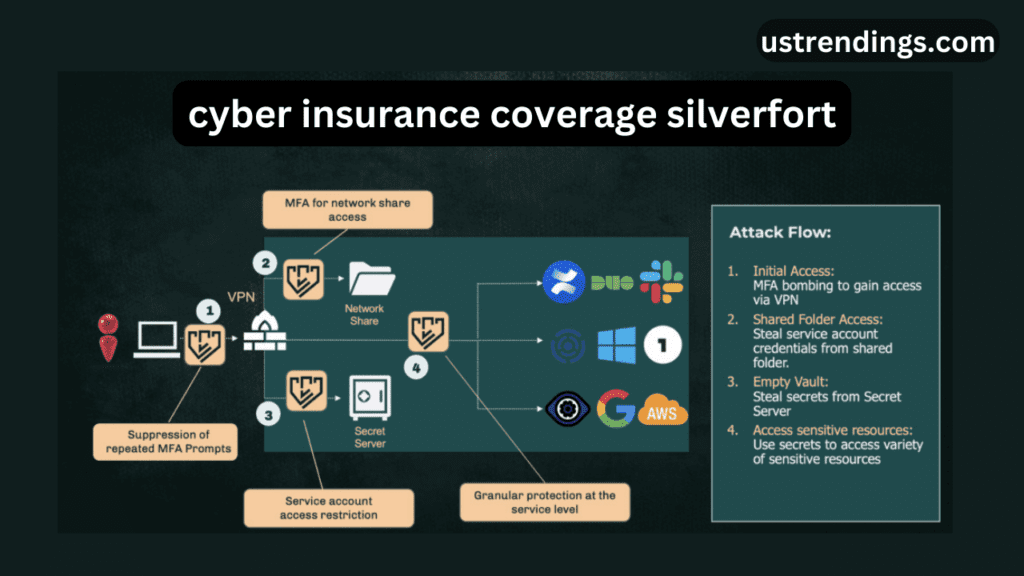

Silverfort’s solution applies MFA to all access interfaces, including command-line tools like PsExec, PowerShell, and WMI which are commonly used in ransomware attacks. The platform also provides real-time monitoring and adaptive access policies to overall security and compliance with GDPR, HIPAA, PCI DSS 4.0 and NY-DFS Part 500.

Cyber Insurance Requirements

As cyber threats increase, insurers are getting stricter. Modern cyber insurance policies require robust security measures, especially around MFA enforcement to reduce data breaches and ransomware attacks.

MFA Enforcement

Cyber insurance providers now require MFA to be applied to:

- Email Systems: Securing access to email platforms like Office 365 or Google Workspace to prevent phishing and unauthorized access.

- Remote Access: MFA on VPNs, remote desktops and virtual environments to prevent external breaches.

- Admin Access: Protecting internal and external admin accounts from privilege abuse.

- IT Infrastructure: Securing servers, networking devices, firewalls and databases.

- Directories: MFA for identity management platforms like Active Directory or Azure AD.

- Endpoints: Servers, workstations and shared file systems.

Not enforcing MFA across these areas can lead to claims denial or disqualification from cyber insurance.

How Silverfort meets Cyber Insurance Requirements

Silverfort solves this with a different approach, beyond traditional MFA solutions.

Agentless and Proxyless

Silverfort eliminates the need for software agents or proxies which are resource hungry and hard to manage in large environments.

- Fast Deployment: Silverfort can be deployed in hours so you can meet your insurer’s deadlines.

- Infrastructure Agnostic: Works without any changes to endpoints or infrastructure even in complex networks.

This design reduces deployment time and no disruption to business.

Full MFA Coverage

Silverfort’s solution applies MFA to all systems and interfaces, including incompatible environments.

- Command-Line Tools: Secures interfaces like PowerShell, PsExec and WMI which are used for lateral movement in attacks.

- Legacy Systems: Protects old applications and systems without native MFA support.

- Hybrid Resources: Covers both cloud-based SaaS platforms and on-premises systems.

- Industrial Systems: Secures operational technology (OT) environments which are often overlooked in cybersecurity.

This covers all the areas to meet cyber insurance requirements and fill the security gaps.

Identity Threat Protection End-to-End

Silverfort does more than compliance by blocking ransomware, credential theft and other attacks.

- Single MFA Enforcement: MFA for all resources, cloud or on-premises.

- Real-Time Threat Prevention: Identifies and blocks unauthorized access attempts, reducing the risk of lateral movement within the network.

- Proactive Defense Against Ransomware: Prevents unauthorized access to critical systems, cutting off one of the main entry points for ransomware.

Silverfort’s end-to-end identity protection is critical for organizations facing growing cyber insurance demands.

Seamless Integration with Identity Providers

One of Silverfort’s strengths lies in its ability to integrate with existing identity providers, simplifying MFA enforcement without requiring additional infrastructure.

Compatibility with Leading Providers

Silverfort integrates with major identity solutions, including:

- Active Directory (AD): Enhances security for on-premises environments without requiring changes to AD configurations.

- Azure AD: Secures access to Microsoft cloud resources and hybrid environments.

- Okta and Ping Identity: Extends MFA coverage for IDaaS platforms used in cloud-first organizations.

Silverfort’s Cyber Insurance Assessment

To simplify compliance, Silverfort offers a free Cyber Insurance Assessment that provides organizations with a detailed understanding of their identity security gaps.

Key Insights from the Assessment

- Admin Account Visibility: Identifies all admin accounts, including “shadow admins,” ensuring that no privileged accounts are left unprotected.

- Service Account Discovery: Maps service accounts and analyzes their privilege levels to identify potential vulnerabilities.

- Security Hygiene: Highlights issues like stale passwords, non-expiring accounts, and weak authentication protocols.

- Active Identity Threat Detection: Detects real-time threats such as brute force attacks, lateral movement, and credential theft.

This assessment not only prepares organizations for cyber insurance audits but also strengthens their overall security posture.

Streamlined Deployment and Time to Value

cyber insurance coverage silverfort design allows organizations to deploy its solution quickly, ensuring they can meet cyber insurance deadlines without operational disruptions.

Ease of Deployment

- No Agents Required: Silverfort’s agentless architecture eliminates the need for endpoint installations, reducing complexity.

- Infrastructure Compatibility: Works across existing systems without requiring upgrades or additional hardware.

Rapid Implementation

Organizations can deploy Silverfort within hours, meeting even the tightest insurance timelines. This ensures immediate compliance and reduces the risk of coverage delays.

Additional Compliance and Security Benefits

Silverfort’s value extends beyond cyber insurance compliance, helping organizations meet broader cybersecurity standards.

Regulatory Compliance

Silverfort aligns with numerous regulatory frameworks, including:

- NY-DFS Part 500: Ensuring compliance with financial institution security standards.

- PCI-DSS 4.0: Securing payment systems and cardholder data.

- NIS2 Directive: Meeting EU requirements for critical infrastructure protection.

- DORA: Supporting operational resilience in financial systems.

Continuous Monitoring and AI-Powered Risk Analysis

Silverfort uses real-time monitoring and AI-driven analytics to identify risks and enforce adaptive policies. This continuous vigilance ensures long-term compliance and protection against emerging threats.

Conclusion

cyber insurance coverage silverfort provides a unified, scalable, and efficient solution for meeting the stringent MFA requirements of modern cyber insurance policies. Its agentless architecture, seamless integration, and comprehensive MFA coverage make it an ideal choice for organizations seeking to enhance their security while simplifying compliance.

With Silverfort, organizations can confidently navigate the complexities of cyber insurance requirements, protect their digital assets, and stay ahead of evolving cyber threats.

FAQs

How does Silverfort simplify MFA enforcement?

Silverfort uses an agentless and proxyless design to extend MFA across all systems, including legacy and cloud environments, without requiring additional infrastructure.

What is included in Silverfort’s Cyber Insurance Assessment?

The assessment provides insights into admin accounts, service account privileges, security hygiene, and active identity threats.

Can Silverfort secure legacy systems?

Yes, Silverfort protects legacy applications and systems that lack native MFA support.

How quickly can Silverfort be deployed?

What identity providers does Silverfort integrate with?

Silverfort integrates with Active Directory, Azure AD, Okta, Ping Identity, and other major identity solutions.

Does Silverfort support regulatory compliance?

Yes, Silverfort helps organizations comply with standards like NY-DFS, PCI-DSS, and NIS2 while enhancing overall security.